Blog | Accountable accounting

For the first six years and three months of Mihaly Slocombe’s existence, we relied on a lean methodology and Microsoft Excel to manage our business. But my growing constellation of Excel spreadsheets eventually began creating as many problems as they were solving. The spreadsheets were only one part of the many facets of our business of course, but the increasing trouble I was having with them triggered a broader realisation that Mihaly Slocombe had outgrown our lean startup strategies.

This is the second article in a series examining how we are transitioning our architecture studio from a lean startup to a more mature business methodology.

Our philosophy in this transition is to make decisions for our business as we want it to be, rather than our business as it is. We want to prepare ourselves for growth, to set up systems that will help us monitor and improve the health of our business, and scale up as we do. We put this philosophy into action at the start of last financial year, and embarked on a three year, three step renovation of our business management systems:

Step 1: Accountable accounting

Step 2: Predictable profitability

Step 3: Communication

Step 1 – 2016

My long love affair with Excel has taught me a thing or two about spreadsheets. I’m no Casanova, but I can handle myself in the digital bedroom and bust out some fancy formulas when the need arises.[1] I’ve discovered what Excel is good at, and more recently, where it’s limited.

Excel is very good at extracting rich insights about our business, like profitability. This is a high effort / high reward activity. For example, I have a master spreadsheet in which I log every invoice we ever issue, how many hours it takes us to earn each invoice, how many hours we therefore spend on each project, and how long it takes our clients to pay. This spreadsheet is time-consuming and complex to manage, but immensely insightful.

Excel is also very good at keeping track of simple things, like time or expenses. These lists started off low effort / low reward, but as our business grew they grew too. Eventually, they became high effort / low reward.

By the start of last year, I had accumulated high effort / low reward spreadsheets for time, expenses, reimbursable expenses, travel, BASs, payroll, PAYG and superannuation. What’s worse, the more work I put into them and the more custom formulae I used, the less transferrable they became. I was the only person able to navigate my maze of spreadsheets, meaning I was the only person able to run the finances of our business. Step 1 of our business transition was to shed them all.

But what to replace them with?

As it turned out, this was the easiest decision in the world to make. There are three main cloud-based accounting packages available in Australia: Xero, MYOB and QuickBooks.[2] But only Xero was designed from the ground up in the cloud and with small business in mind. A chat with our accountant revealed that she subscribes to Xero and MYOB but generally recommends Xero. So we signed up for Xero.

…And it was like trying to read the operating manual for the Starship Enterprise in Klingon. I was totally lost. Fortunately, our endlessly patient bookkeeper is fluent in Klingon, and taught me how to master the new piece of software.[3] I had some headaches early on with payroll for part-time staff, and it took me around 6 months to get the hang of it, but Xero has well and truly won me over.

It isn’t as endlessly customisable as Excel, but it’s faster, less error-prone, more transparent, and will scale with us as we grow. It’s pretty cheap too ($60 per month for us), and just as well supported. Payroll is now so easy I have our five year old come in each month and do it.[4] And most importantly, Xero has let me archive all of our troublesome spreadsheets. I was ecstatic to see the backs of them.

Even thinking about handling payroll for our team of six through Excel gives me the heebie-jeebies. Quarterly BASs are much easier than they used to be, and our first end of financial year with Xero is proving to be remarkably straightforward. Between the data it contains and information our accountant can scrape from the ATO, we won’t need to collate even a single piece of information for her ever again.

For me, the main limitation of Xero is invoicing. Our invoices incorporate a lot of information, including our clients’ construction budgets, our percentage fees, and a breakdown of our phase-by-phase progress. These are important to have on our invoices as they maintain transparency for our clients, but Xero has no way of supporting this type of detail. So I still rely on Excel to handle invoicing, and can only dream of one day being able to afford to commission a custom invoicing app. Some people dream of buying a personalised Porsche when they’re rich and famous, me I dream of a personalised Xero plugin.

All up, year one of our renovation plans has been a success. With Xero we have established a robust accounting tool at the heart of our business. Should we grow from six people to sixty, it will grow with us. And should we finally decide to outsource our bookkeeping, we’ll be able to take on a permanent bookkeeper with minimum fuss.

But we still use Excel for timesheets, resource scheduling and project planning. The next step in our three year plan is to throw these spreadsheets in the bin too. Stay tuned for step two, where I’ll share the results of my research into a couple of dozen different resource scheduling tools, and the software solution we’ve decided to pursue.

Footnotes:

- I use this bad boy to count the number of hours worked on each phase of a project:

=SUMPRODUCT(SUMIF(INDIRECT(“‘”&$K$97:$K$107&”‘!D1:D1000”),$A10,INDIRECT(“‘”&

$K$97:$K$107&”‘!”&B$97:B$107)))

Or this ridiculous one which tells the above formula where to look for those hours:

=LEFT(ADDRESS(7,MATCH(B$96,INDIRECT(“‘”&$K98&”‘!7:7”),0),4),LEN(ADDRESS(7,

MATCH(B$96,INDIRECT(“‘”&$K98&”‘!7:7″),0),4))-1)&”:”&LEFT(ADDRESS(7,MATCH(B$96,

INDIRECT(“‘”&$K98&”‘!7:7”),0),4),LEN(ADDRESS(7,MATCH(B$96,INDIRECT(“‘”&$K98&”‘!7:7”),0),4))-1) - This time last year, Xero had 312,000 Australian subscribers, MYOB had approximately 120,000 and Quickbooks 53,000. Edmund Tadros; QuickBooks users jump by 60% but Xero, MYOB remain leaders; Australian Financial Review; October 2016.

- I strongly recommend anyone switching to Xero or a similar accounting package to seek assistance setting it up. During the onboarding process, there are dozens of insurmountable questions that really aren’t. Our bookkeeper came into the studio for a three invaluable half day sessions in the first month. These days I have her on call just in case I encounter anything particularly perplexing.

- This is a joke. I actually have our two year old come and do it.

Image sources:

- Xero logo; sourced from Wikipedia; accessed June 2017.

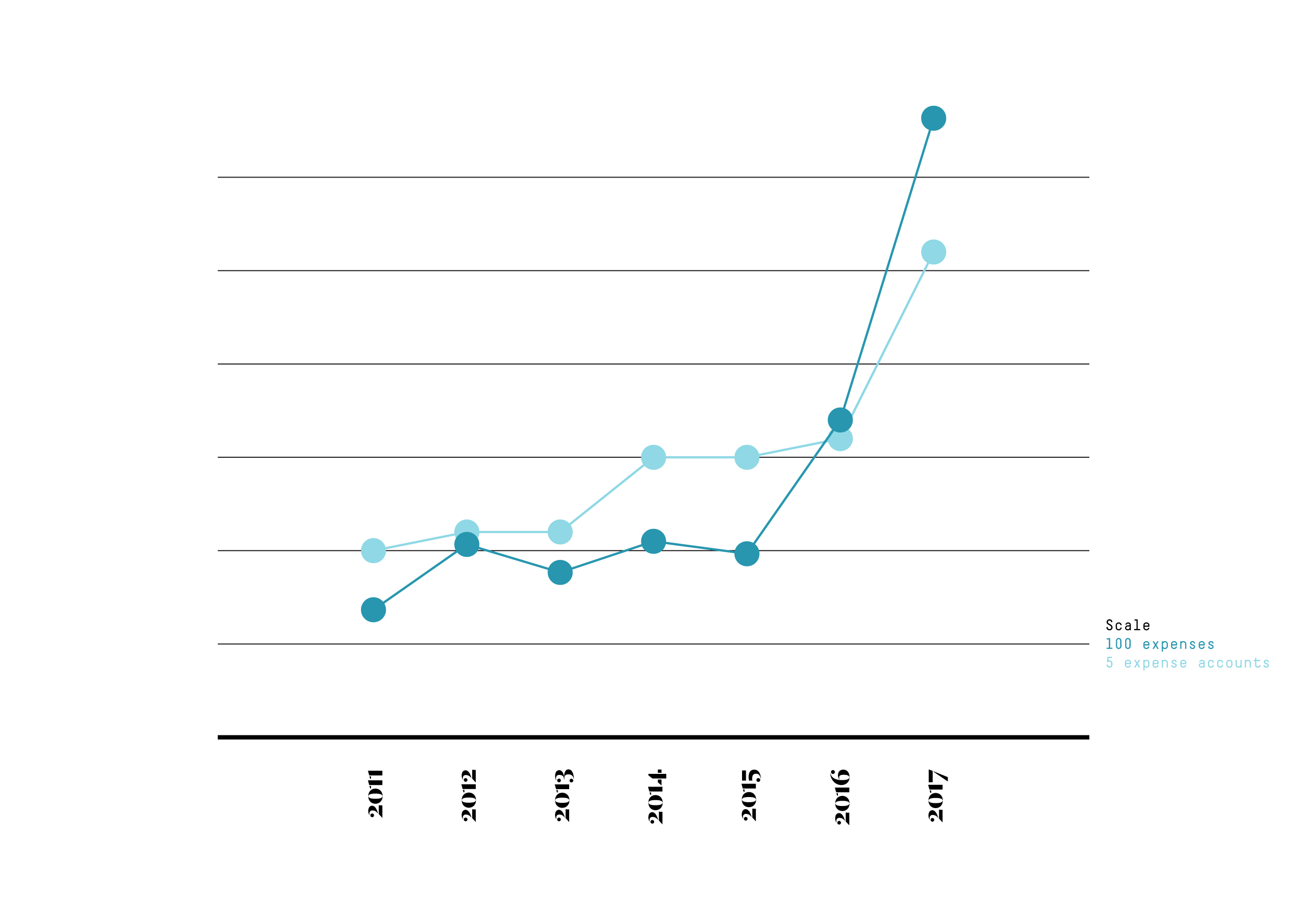

- Expenses and expense accounts; author’s own image.

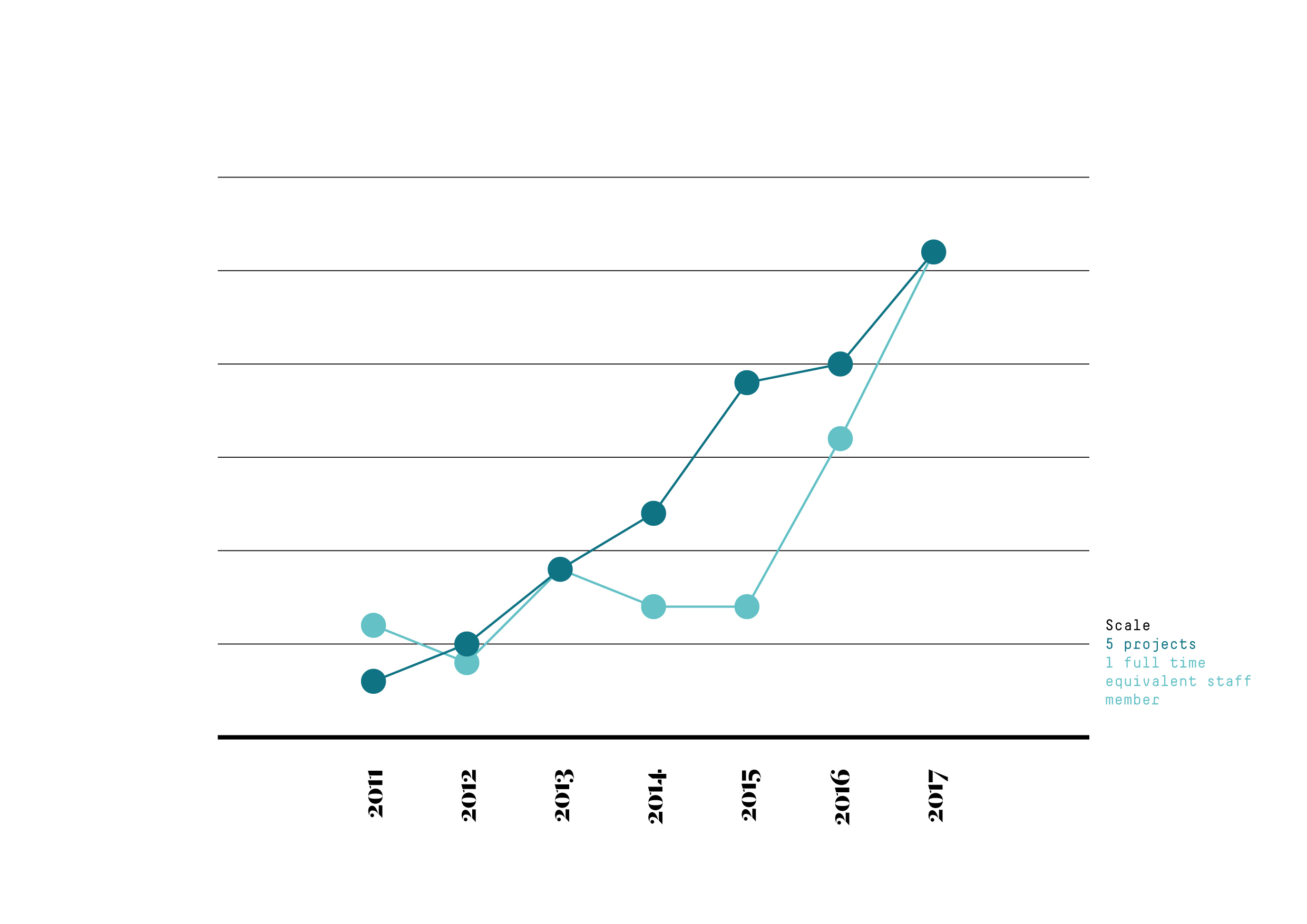

- Projects and staff; author’s own image.